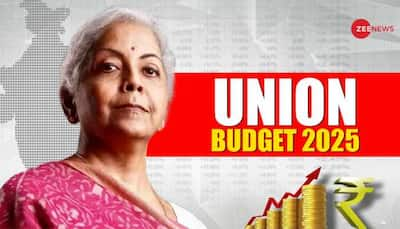

NEW DELHI: The government on Saturday proposed to enhance annual threshold for deduction of tax at source (TDS) on rent to Rs 6 lakh from the current limit of Rs 2.4 lakh. “I propose to rationalise Tax Deduction at Source (TDS) by reducing the number of rates and thresholds above which TDS is deducted. Further, threshold amounts for tax deduction will be increased for better clarity and uniformity,” Finance Minister Nirmala Sitharaman said in her Budget speech.

She announced that the “annual limit of Rs 2.40 lakh for TDS on rent is being increased to Rs 6 lakh”. This will reduce the number of transactions liable to TDS, thus benefitting small taxpayers receiving small payments, the finance minister added.

According to the Budget document, Section 194-I of the Income Tax Act requires that any person, not being an individual or a Hindu undivided family, who is responsible for paying to a resident any income by way of rent, should deduct income tax at the applicable rates, only when the amount of such rental income exceeds Rs 2.4 lakh in a financial year.

“It is proposed to increase this threshold amount of income by way of rent for requirement of deduction of tax at source from Rs 2.4 lakh in a financial year to Rs 50,000 in a month or part of a month,” it added.

Stay informed on all the , real-time updates, and follow all the important headlines in and on Zee News.