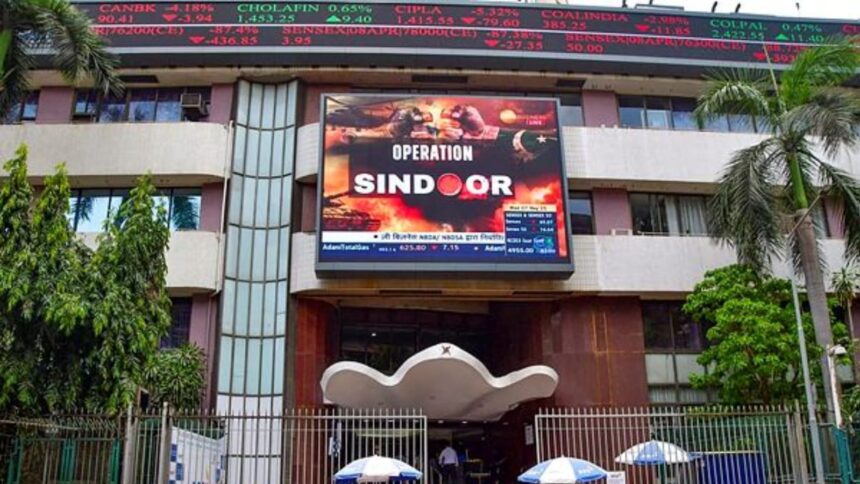

Domestic stock market indices, Sensex and Nifty, declined 1 per cent on Friday as investors become risk averse due to the ongoing India-Pakistan tension.

The BSE’s 30-share Sensex tanked 1.1 per cent, or 880.34 points, to close at 79,454.47. The index swung 1,065 points during the day. The slipped 1.1 per cent, or 265.8 points, to settle at 24,008.

The India VIX, an indicator of the market’s expectation of volatility over the near term, rose 2.97 per cent to 21.63 per cent. The volatility index had surged by 10.21 per cent the previous day.

On Thursday evening, India’s air defence systems intercepted more than 50 missiles fired by Pakistan toward key border regions and also shot down four Pakistani aircraft. This escalation has raised investor concerns and is likely to lead to heightened intraday volatility.

“A conflict was anticipated but the market was not expecting the situation to intensify, raising concerns about its duration. However, it is still projected to be a short-lived confrontation, given the strategic advantage and the opponent’s weak economic standing,” said Vinod Nair, Head of Research, Geojit Investments Ltd.

In normal circumstances, on a day like this, the market would have suffered deep cuts. But this did not happen due to two reasons. One, the conflict, so far, has demonstrated India’s clear superiority in conventional war fare, and therefore, further escalation of the conflict will inflict huge damage to Pakistan. Two, the market is inherently resilient supported by global and domestic macros. Weak dollar and potentially weakening US and Chinese economies are good for the Indian market, analysts said.

“Traders don’t want to get caught off guard by risking their investments as any escalation in war during the weekends could trigger major selling starting next week,” said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

Nifty Midcap 100 fell 0.01 per cent and Nifty Smallcap 100 was down 0.61 per cent.

Among the sectoral indices, Nifty Realty fell 2.38 per cent and Nifty Financial Services Ex-Bank declined 1.49 per cent.

The NSE companies that fell the most included ICICI Bank fell (3.24 per cent), Power Grid Corporation (2.74 per cent), (2.22 per cent) and Ultratech Cement (2.22 per cent).

Experts said that investors should not panic and exit from the market now if the conflict escalates or it continues for more days.

“Remain invested, monitor the developments and wait for the dust to settle,” said a veteran market analyst.

“As we have been alerting our readers, it is prudent to prepare rather than panic. We advise traders to keep leveraged and speculative positions light and use derivatives to hedge short-term exposures,” said Devarsh Vakil, Head of Prime Research, HDFC Securities.

On Friday, foreign portfolio investors (FPI) net sold Rs 3,798.71 crore of equities, while domestic institutional investors (DIIs) purchased Rs 7,277.74 crore of shares, according to the BSE’s provisional data.