Wholesale price inflation dropped to a 13-month low of 0.85 per cent in April with softening in prices of food articles, fuel and manufactured products, with experts projecting further easing in the data of next month, government data showed on Wednesday.

WPI-based was 2.05 per cent in March. It was 1.19 per cent in April last year.

WPI inflation lower than 0.85 per cent was last recorded in March, 2024, when it was 0.26 per cent.

“Positive rate of inflation in April, 2025 is primarily due to an increase in prices of manufacture of food products, other manufacturing, chemicals and chemical products, manufacture of other transport equipment and manufacture of machinery and equipment, etc,” the industry ministry said in a statement.

As per the WPI (Wholesale price index) data, deflation in food, and fuel and power WPI, along with disinflation in manufactured products drove the moderation.

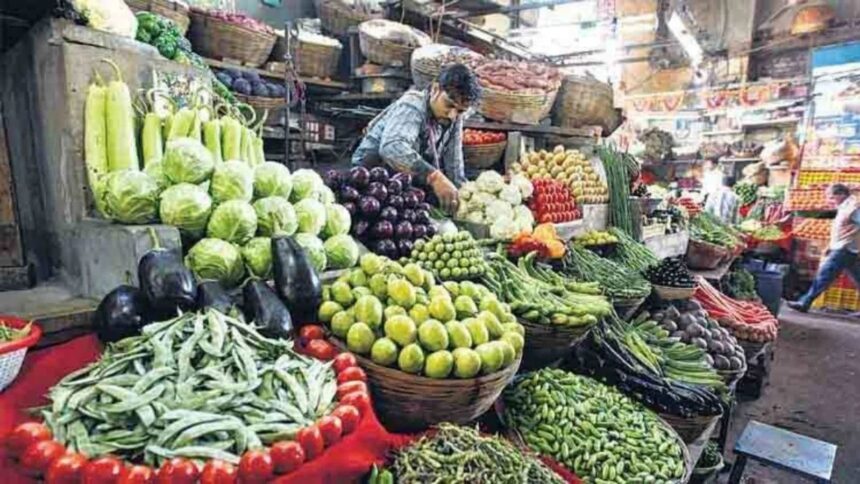

Food articles saw a deflation of 0.86 per cent in April, against an inflation of 1.57 per cent in March. Deflation in vegetables was 18.26 per cent during April compared to deflation of 15.88 per cent in March.

In onion, inflation eased to 0.20 per cent in April, as against 26.65 per cent in March. Inflation in fruits softened to 8.38 per cent, from 20.78 per cent in the previous month.

Potato and pulses saw a deflation of 24.30 per cent and 5.57 per cent, respectively.

“Favourable base effects to keep WPI inflation low in coming months,” Barclays said in a research note.

Deflation in fuel and power was 2.18 per cent in April, compared to a 0.20 per cent inflation in March.

“Sharp sequential decline in prices of mineral oils such as kerosene (which was also reflected in consumer prices) and ATF and motor fuels, drove this fall,” Barclays said.

Crude oil prices have generally remained in the USD 60-65/ barrel handle in April, with downward pressure arising from OPEC+ announcing production increases. OPEC+ is a group of 23 oil-producing countries that work together to manage the supply of oil in the world market in order to influence global oil prices.

Manufactured products, however, saw inflation at 2.62 per cent in April, compared to 3.07 per cent in March.

ICRA Senior Economist Rahul Agrawal said the IMD’s expectation of an early monsoon onset in Kerala and an above normal monsoon in the country is a positive for crop output, and consequently, the food inflation outlook, although the spatial and temporal distribution of the same remains key.

“We expect the WPI to average sub-2 per cent in FY2026, which, along with our CPI inflation and real GDP projections for the fiscal implies that nominal GDP growth may be capped at 9 per cent,” Agrawal said.

Data released on Tuesday showed retail inflation eased to a near 6-year low of 3.16 per cent in April mainly due subdued prices of vegetables, fruits, pulses, and other protein-rich items.

Easing of inflation would create enough room for the Reserve Bank, which mainly takes into account retail inflation while formulating monetary policy, to go in for another round of rate cut in the June monetary policy review.

In April, the RBI cut the benchmark policy rate by 0.25 per cent to 6 per cent. This was the second cut during the year to stimulate the economy, facing the threat of US reciprocal tariffs. The RBI sees retail inflation averaging 4 per cent in the current fiscal from the previous estimate of 4.2 per cent.